- #LIST OF QUICKEN REPORTS SOFTWARE#

- #LIST OF QUICKEN REPORTS PLUS#

- #LIST OF QUICKEN REPORTS FREE#

- #LIST OF QUICKEN REPORTS WINDOWS#

Users can create and email custom invoices from available templates within the software, adding their own logo and color scheme.

#LIST OF QUICKEN REPORTS SOFTWARE#

Quicken also has robust invoicing abilities, however not as good as other invoicing software on the market. Automated alerts can also let users know when their invoices have been viewed by a client, even if they haven't paid. Once set up, a project's billable hours can be automatically folded into the correct invoice once the invoice payment rolls in, QuickBooks' automatic matching function will then find and pair the payments to its invoice, letting users know which invoices are done and which are outstanding. QuickBooks offers customizable invoice templates, including recurring invoices that will be automatically issued at set intervals. That said, Quicken is a great inexpensive solution for small businesses with no inventory: Freelance marketing or design, for instance, or rental property management.

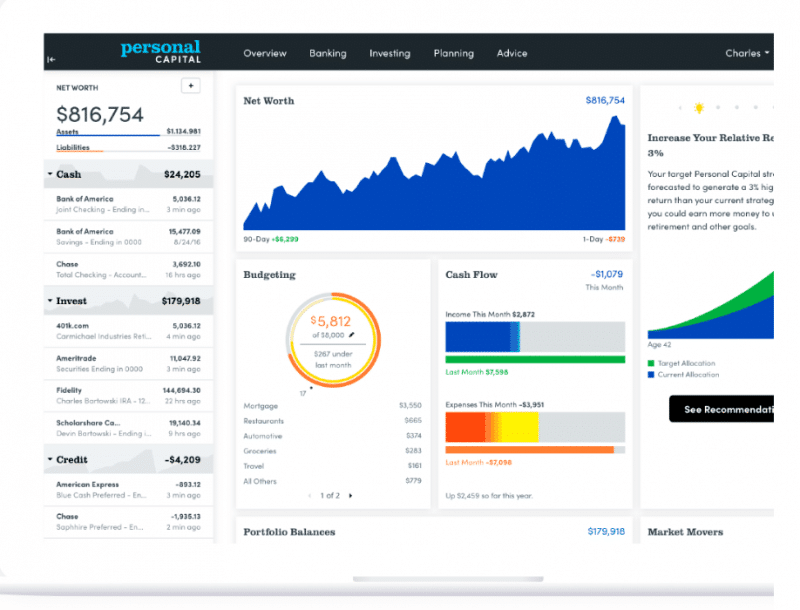

While both services can be used to operating accounting services for a small business, QuickBooks is more likely to be worth the cost for any serious business owner. That said, Quicken offers fewer features, less customizability, and less functionality overall. Quicken is far less expensive than QuickBooks, charging an annual fee that's in the same ballpark as QuickBooks' monthly fee. With the exception of Starter, Quicken's plans will all be 10% off for the first year. Quicken does not offer a trial, but does have a 30-day money-back guarantee, which is kind of the same thing if you're willing to be that person who asks for their money back.

#LIST OF QUICKEN REPORTS PLUS#

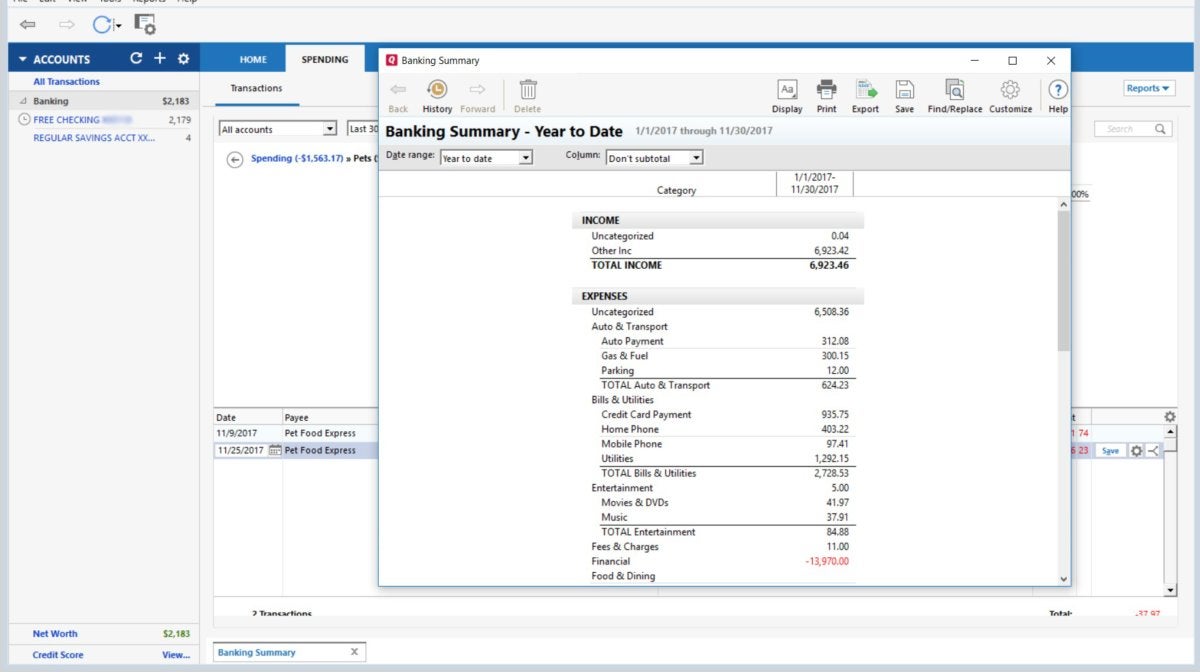

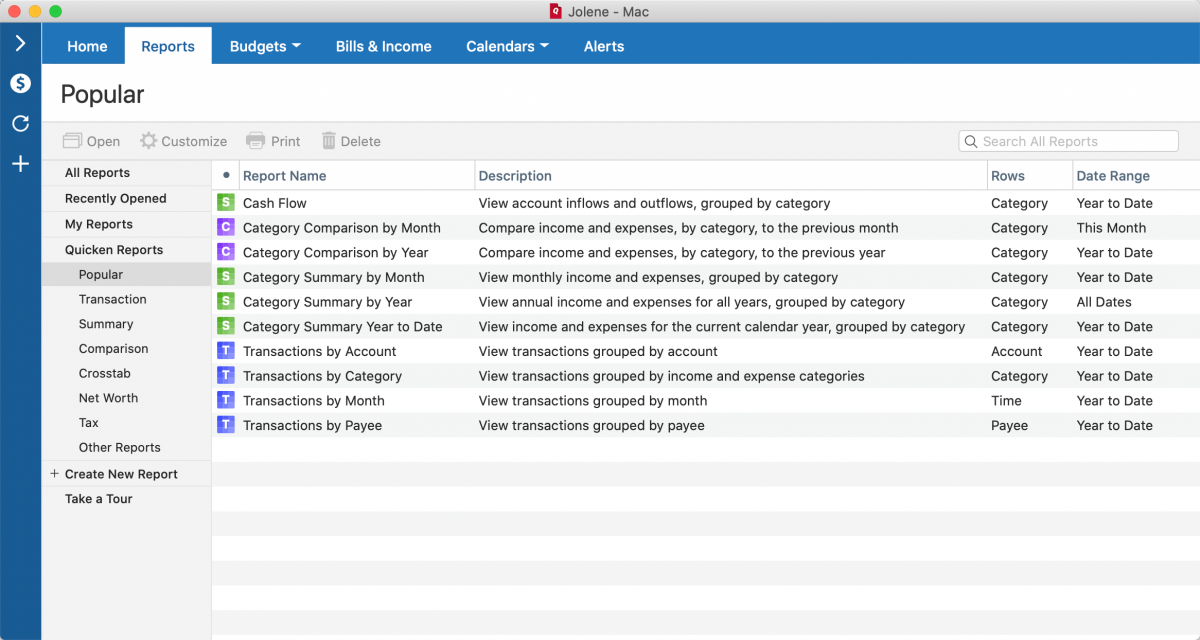

It offers all the features of Premier, plus a block of business and property management tools you won't find in any other plan: Categories to separate personal from business expenses, profit/loss projections, cash flow reports, Schedule C and E report creation, custom email invoices and estimates, and management for lease terms, rental rates, security deposits, rents (both outstanding and paid), and rental documents.

#LIST OF QUICKEN REPORTS WINDOWS#

Quicken Home & Businessįinally, Quicken's Home & Business plan costs $103.99 per year, and comes with one big caveat: It's only available on the Windows operating system, unlike the other three plans, which are on both Windows and Mac. These include better portfolio analysis, comparisons to market average returns, Schedule D tax report creation, and Quick Pay digital bill payments.

#LIST OF QUICKEN REPORTS FREE#

This nets you all the Deluxe features, plus free online bill payment, priority customer support, and a host of tools to further streamline tax planning. That's not a huge increase in features, but it's also not a huge increase in costs, and the features you do get are essential to long-term retirement planning making this Quicken's most popular plan. It offers all the features of Starter, plus customized budgets and both tracking and savings goals for debts, loans, investments, and retirement accounts.

You'll also get phone support, and be able to export data to Excel. You'll be able to tracking spending, bills and budgets, see your bank and credit card accounts, and categorize expenses, all across desktop, web, or mobile alike. Quicken's first plan is Starter, for $35.99 per year. That's it for the core plans, but there's also QuickBooks Payroll, an add-on available in three plans: Core, for $45 per month plus $4 per employee per month Payroll Premium, for $75 per month plus $8 per employee per month and Payroll Elite, for $125 per month plus $10 per employee per month. This plan includes a few features you won't find in the others: There's quarterly tax management complete with alerts perfect for a freelancer as well as estimate tracking, 1099 contractor management, and sales/sales tax tracking. QuickBooks Self-Employedįinally, the Self-Employed plan costs $15 per month for one user. It offers all the features of Plus, and throws in priority customer support, advanced reporting, online training courses, batch importing abilities, and role-based user permissions for better security. QuickBooks Advanced costs $150 per month, and supports 25 users. It has all the features of Simple Start, plus time tracking, project profitability tracking, inventory and bill management, and a project hub, which lets users tie specific labor costs, payroll data, and expenses to the project to which they belong. Next is the QuickBooks Plus plan, which costs $70 per month and supports five users. A range of third-party integrations offer further functionality, though some are paid add-ons rather than free extensions. This plan supports unlimited invoicing and estimating, expense tracking, contact management, limited reporting features, and a mobile app. QuickBooks' Simple Start plan costs $25 per month, and supports one user.

0 kommentar(er)

0 kommentar(er)